Man Obsessed With Paying Down Debt Wants His Fiancée to Work 80-Hour Weeks

Updated Feb. 14 2020, 1:06 p.m. ET

There's no doubt that millennials are grappling with a ton of debt. And while it's admirable to make becoming debt-free a priority, it's possible to take things too far.

Case in point: a recent debt-obsessed gentleman who posted to reddit's "Am I the A--hole" community seeking validation for his perfectly reasonable plan for him and his fiancée to pay off their debt before they get married.

(Spoiler alert: it is not at all reasonable.)

Reddit user Different-Basis explains in his post that he has been working 80 hours a week with the goal of paying off his $70k student loan debt by the beginning of next year. And he wants his 28-year-old fiancée to take a second, full-time job as he did, to pay off her debt of $60k, the majority of which seems to be credit card debt she accrued to help cover her father's cancer treatment.

Understandably, his fiancée isn't keen on the idea of working more than she already does as a teacher who works over 60 hours a week as it is, and furthermore, she's not loving that he spends all his time working. She says with her history of depression, working even longer hours would not be good for her health.

His argument is that the debt hanging over their heads affects his mental health and that he also struggles with depression but has been able to manage working 80-hour weeks just fine, so she should be able to as well. If that were the end of his demands, I would already be prepared to rule against this man on who is being the a-hole. But after reading his post further, I mostly want this man to get help, because his obsession with becoming debt-free is bordering on pathological. Get a load of some budget details he shared.

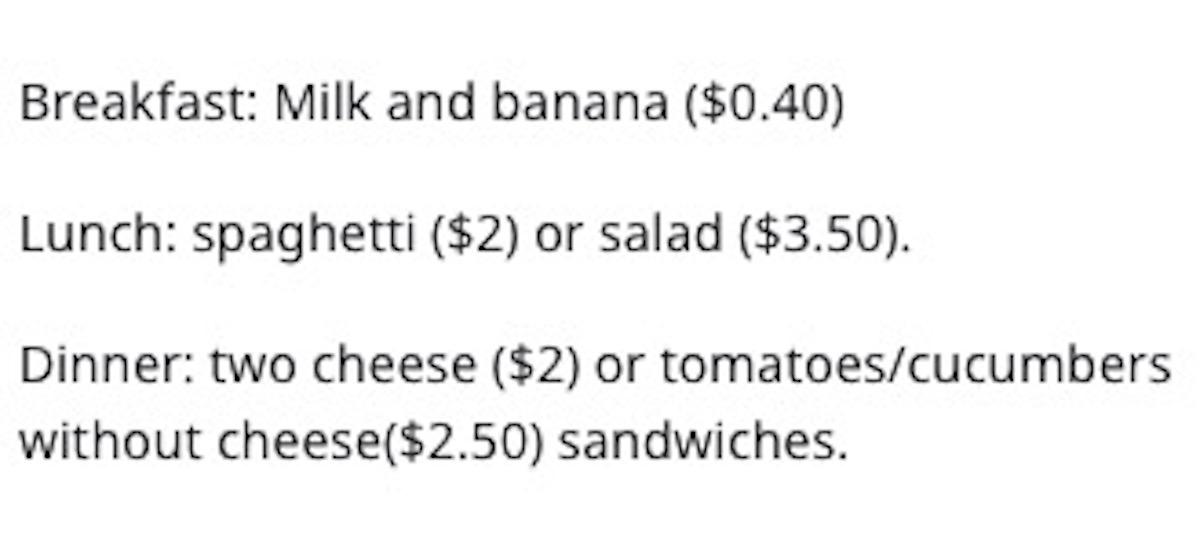

For one thing, he thinks it's reasonable to limit food spending to $350 a month, and then lists a sample menu that does not sound like enough food to sustain an adult.

Even on the most generous days where they might consume spaghetti instead of salad and cheese sandwiches instead of "tomatoes / cucumbers without cheese" sandwiches, you're looking at around 1200 calories per person. He also wants her to limit salads to weekends. This is not a nutritious menu! This is no way to live!

The austerity measures don't end with groceries. He asked her to cancel her gym membership because running on the streets is free, not taking into account the safety issues for women running alone at night.

To people (including his fiancée) who argue his attitude is harming their relationship, he says if they don't eliminate their debt they "would definitely get divorced because money problems cause fights." And as to her argument that overworking would be detrimental to her mental health he says debt is just as much a mental health threat.

He's definitely right that debt is causing him mental distress, but it's less the existence of it than his obsessive-compulsive fixation on paying it off on such a short timeline. Just reading his post gave me a mini anxiety attack.

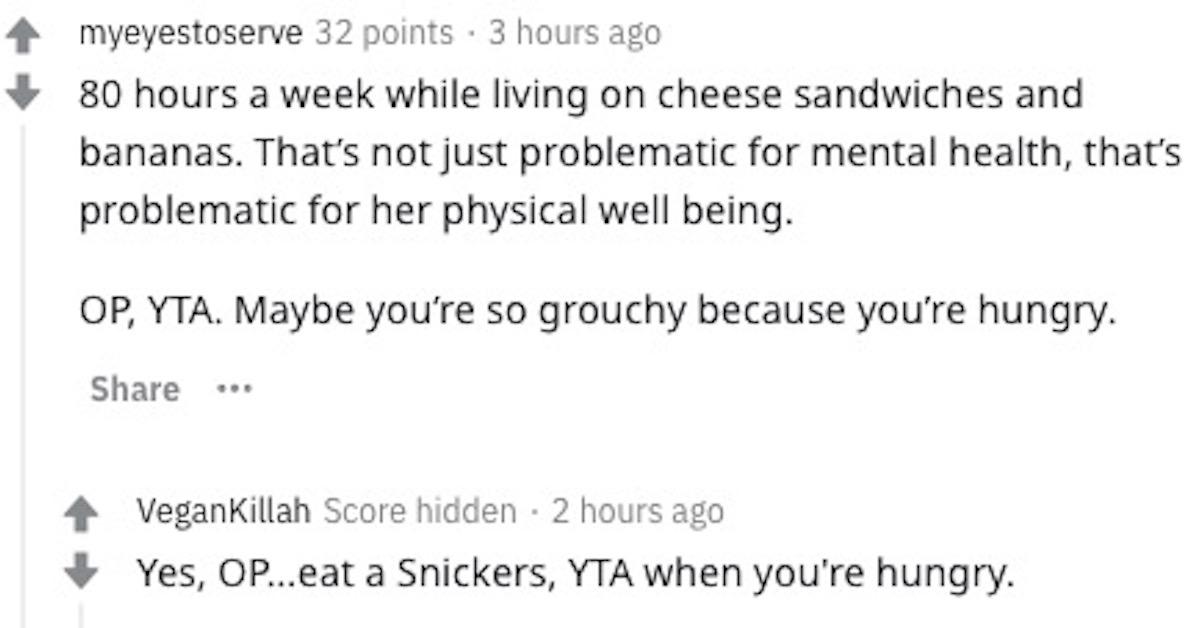

As many commenters on AITA suggested, what OP truly needs is to allot some of his budget to a therapist who can help him work through the anxiety issues he's clearly carrying with him, as well as his deep need for control. Especially since that need for control extends beyond his own circumstances to trying to control what his fiancée eats and every aspect of how she spends her money.

The consensus was pretty clear: OP needs to seek help and his fiancée should consider getting out now unless he sees the light soon. "You’re not seeing the forest for the trees," writes the top-rated commenter on his post. "Your solutions are just ways to make life unenjoyable. What you really need is a longer term financial plan that is realistic to maintain. The current one is crazy talk."

Down in the comments, he says, "I guess if we have different priorities for money, we shouldn't get married." He's got one thing right. They definitely shouldn't get married.