Did Elon Musk's Interference Give Borrowers the Right to Dispute Student Loans?

Did Elon tunnelling into Department of Education programs provide a way out of student loan debt?

Published Feb. 12 2025, 2:55 p.m. ET

Ever since President Donald Trump returned to the White House for Trump 2.0, things have been chaotic in Washington. Billionaire and Trump buddy Elon Musk has been stampeding through government agencies with what appears to be a carte blanche approval.

After news broke that Elon had dug into information held by the Department of Treasury and Department of Education, many wondered what it meant for their sensitive financial and personal data.

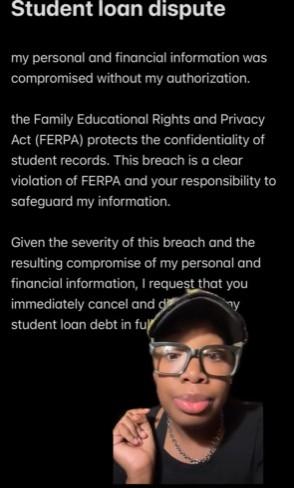

On TikTok, many videos have popped up suggesting how people should react to the intrusion and data breach. Some have suggested filing a dispute requesting loan servicers to dismiss their loan obligations since their privacy was violated. But will that work? Here's what we know.

Can you file a dispute dismissing your loans after Elon Musk and his buddies broke into the Department of Education? Not quite.

Things are chaotic right now with the Department of Education (ED), and the agency is even facing a lawsuit from college students in California who allege that the ED has violated their privacy by providing access to their private data.

Over a dozen Democratic lawmakers have also demanded clarity from the ED as to what Elon and his Department of Government Efficiency (DOGE) employees have gained access to.

TikTok videos claim that Elon has violated the Family Educational Rights and Privacy Act (FERPA), and suggest borrowers should dispute their loans and request a dismissal.

But the Supreme Court already ruled on this topic back in 2002. According to Newsweek, they declared that borrowers do not have a private right to sue for FERPA violations, even if their privacy was violated. Only the federal government can bring that suit.

The ED said in a statement to Newsweek, "[Federal Student Aid] has not engaged in any activities that would expose your data through unauthorized or unlawful means. We are subject to all Federal Government and U.S. Department of Education record retention laws and standards, including the Privacy Act of 1974. FSA is committed to safeguarding your personal information by adhering to all applicable laws around the management of customer data."

So, unfortunately, violating FERPA does not mean Elon just gave you a quick pass to getting your loans forgiven. While that may be a dream for many, this method won't be the vehicle to make that happen.

People's reactions might not be what you'd expect.

Despite all the misinformation, TikTok is reacting to the news as though it's true. But people's reactions might surprise you.

There are, of course, people celebrating the idea of having their student loans disputed and dismissed. After all, student loans are often considered predatory and leave the borrower paying high interest rates for decades after they graduate.

But as it turns out, plenty of people just aren't paying theirs no matter what. In the comment section of a TikTok video explaining how to file the aforementioned dispute, the first comment reads, "I wasn't paying anyway!" with a laughing emoji.

Under that comment, many people replied that they also weren't paying on theirs.

Between a federal pause during COVID and a number of economic stressors putting student loan payments out of reach for many, it's not surprising to find that many people simply can't afford it if the choice is between paying the government back or buying food for their family.

It's important that people are educated about what happens if they fail to repay their active student loans, however. First and foremost, it can ding your credit. Most major loan companies will report to the three major credit bureaus after 90 days of nonpayment. So that's something to consider.

But they can eventually escalate, automatically withdrawing part of your paycheck through wage garnishments or even withholding your federal tax return. You may even face a lawsuit.

For some people, they have no choice and the penalties are necessary.

But if you're looking to fight your student loans, just make sure you're doing it with sound legal advice. It's often best to pay until you're sure your forgiveness has been approved or your loan has been discharged.

Consult with a lawyer regarding your rights and responsibilities if you're looking to fight your way out of the loans, and be prepared for the long haul.