“I Lose Around 300 a Check” — High School Student’s Harsh Tax Revelation Goes Viral

Updated Jan. 18 2024, 1:23 p.m. ET

America was founded under a very simple premise: people didn't want to pay taxes. In fact, the tax rate wasn't even very high by today's standards: it stood between 1.-1.5 percent.

But our founding fathers and folks living in the colonies were like, "screw this noise" and threw an absolute revolutionary fit and managed to beat the world's most redoubtable superpower out of their sheer disbelief that someone would try to take their money despite doing nothing to earn it.

It's a far cry from the tax rates that many Americans are subjected to paying both the Federal and State governments. There are countless instances where corrupt US Government officials have been caught stealing our tax dollars: pork bills backed by media propaganda machines are passed, the money is then laundered so many times over and passed through so many organizations, companies, and LLCs that we don't even know where it ends up.

It's a disgusting state of affairs and one that is perfectly summed up in an interaction a teacher and TikToker named Amber (@amber.marie44) had with a student who just learned about taxes.

Suffice to say, the student was not happy to learn that their earnings were going to some amorphous profit-sucking, faceless entity.

Amber opens a tub of Vanilla flavored Greek Yogurt and begins spooning into it as she talks into the camera: "So I had a student walk into my class today and she was pissed off. Like I could just tell right off the back she was not in a good mood. I'm like hey girl what's up? And she's like I can't even today. This is the worst day of my life, nothing is, nothing's worth anything anymore."

Amber then went on to detail more of her conversation with the student, and how she came to find out what was making the young woman so glum: "I'm like what do you mean? You know what happened? She's like well I got my first job last week and I worked 32 hours. I'm like wow 32 hours is a lot for a high school student, first of all, but I was like wow that's good."

But it wasn't good, according to the student, because she didn't know so much of her paycheck was going to be cut out for taxes: "I just finally got my first check and I'm supposed to be getting paid $17 an hour for 32 hours she's like and I did the math and I know how much money I was supposed to make and then I got my check and it was way less."

Amber continued to detail her student's irate reaction to discovering that her income was taxed at such a high rate: "So I'm like well what do you mean? And she's like the taxes she was like the taxes took up almost half of my entire check. She was like I knew that people hate taxes but I didn't realize that they were taking hundreds of dollars out of every paycheck."

The teacher then delineated her response to the student: "I was like oh yes girl welcome to America. And then she was saying how like it doesn't even make it worth it to work anymore because the amount of work that she's putting in does not correlate to the amount of money that she's getting. And she asked me she was like do they do this to your check too?"

Amber said that she totally understood where her student was coming from: "I'm like yeah girl they do it to everybody's check. Everyone gets taxed. She's like I think I'm going to quit my job and I don't think I'll ever get a job again because that's insane. Why am I working to only get half of the money I made and I'm like girl preach it because I get it. But it made my heart so sad for her because I knew how excited she was to get this job."

"And I knew all the things that she wanted to buy when she finally got her first paycheck and how excited she was to finally have her own money and then to realize that she's not gonna be getting paid what she thought she was getting paid. It hurts, I remember, I remember my first check. I remember the heartbreak."

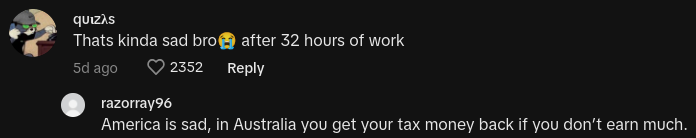

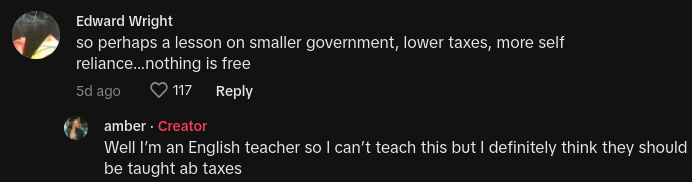

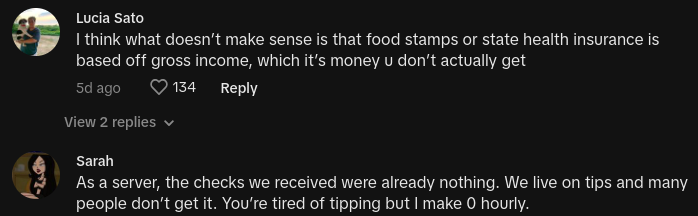

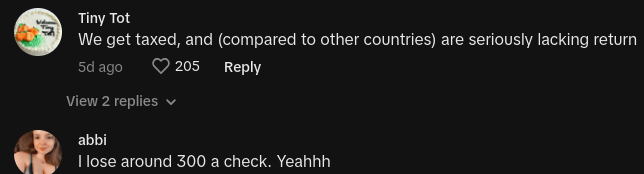

Commenters seemed to agree with Amber's student's assessment of the current tax situation in the United States, saying that she wouldn't mind being taxed if the money was being put to good use: "It would make sense if the money that would taken out would ACTUALLY benefit us," to which Amber responded with a simple: "this."

Another person made a good point: how are teenagers getting their money taxed if they aren't even old enough to vote? "And the saddest part is they can’t even vote! Taxation without representation I believe?" one person wrote.

However someone else said that according to W-4 IRS tax forms that teenagers are not obligated to pay taxes: "Read the instructions to the W-4 IRS form a look at the section that says exemption. You will notice that most teens are exempt," however there are other analysts who state that age doesn't play a factor in determining whether or not Uncle Sam takes money away from kids who aren't old enough to drink yet.