Restaurant’s "Honest to Goodness" Fee Sparks Outrage on TikTok

Updated April 4 2023, 9:19 a.m. ET

Working in the foodservice industry can really be a mixed bag. From dealing with rowdy and downright nasty customers to having to fight for fair wages, to dealing with staffing issues, it can certainly feel like a daunting job that isn't really worth the pay that one's receiving at the end of the day.

On the flip side, however, customers are sometimes dealt a raw deal due to restaurant policies, too. Who's ever been surprised by a lack of free fountain soda refills at their restaurant? Or perhaps been on the receiving end of sub-par or deceptive service, like "tourist trap" Nusr-Et steakhouse from the "Salt Bae" himself that doesn't show the prices of some menu items and then hits customers with a fat bill despite serving up sub-par food.

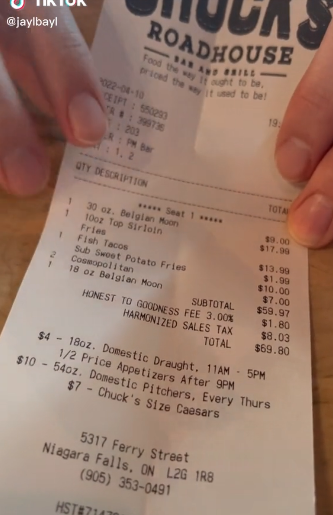

Or being hit with confusing additional charges that make you do a double take, like something a Chuck's Roadhouse customer questioned while looking at their receipt after visiting one of the chain's dining establishments.

Jaylin, who posts under the username @jaylbayl on the popular video-sharing platform pointed out an "honest to goodness fee" along with a "harmonized sales tax" charge.

So what is an honest-to-goodness fee? Some people thought that it was reserved for servers to ensure that they were getting compensated extra per every table that they manage. It's hard to argue that the added money on higher trafficked restaurant days could incentive some servers to stay at a location and make them feel added gratitude/worth for the extra effort.

This is a sentiment some TikTokers expressed, stating that the servers should "better make honest to goodness money" as a result of the charge. There were others who said that if they saw that charge on their receipt they would never eat at the restaurant again.

However, as it turns out, this isn't what Chuck's Roadhouse says that the added fee is for.

As per the company's website: "The "honest to goodness fee" is added as a means of ensuring a higher quality of food for its customers. The charge adds about three cents to every dollar of a menu item.

The Canadian restaurant chain's fee was also featured in a story by CTV News which interviewed some customers of the establishment and asked if they took issue with it.

Some said it was "confusing" while others expressed that they didn't mind it as it was placed on the receipt and the restaurant explained what it was for. There were others who thought that the price should just be wrapped up in the cost of the food items that they're ordering.

A food economist said that the pricing structure of the charge is a "bit disingenuous." As for the harmonized sales tax, this is a charge found on many purchases made in Canada which takes into account the country's Federal sales tax along with a specific location's local laws. In Ontario (which is where this restaurant's at), the harmonized sales tax is 13%.

Chuck's Roadhouse went on to tell the Canadian news outlet that its prices, even with the tax, are competitive with other restaurant chains in the nation.

What do you think? Should the charges just be included in the items? Or is the business free to list its charges in any way that they see fit and let customers decide if they want to come back?