Here's Why You Should Try the 52-Week Money Challenge

Updated Jan. 8 2021, 12:42 p.m. ET

It's no secret that saving money can be super tricky for some people. You might think you're doing great, but then you buy a coffee here, get drinks with friends there, splurge a little on a new outfit — next thing you know, all that "extra" money you thought you had saved is nowhere to be found! But what if we told you there's a creative and effective way to boost the amount of money in your savings account?

Enter the 52-week money challenge. This simple trend will not only grow your savings but also help you develop better financial habits in the future. Now that we're officially at the beginning of 2021, it's the perfect time to start the challenge (but don't worry if you're coming to the trend a little late). Curious to see how the 52-week money challenge works? Read on.

What is the 52-week money challenge?

The popular challenge is an incremental savings plan that allows you to stash away a sum of money by the end of the year. If you're looking to build an emergency fund or save for an upcoming vacation, this challenge might be just what you need.

In the first week, you start by saving $1, then in the following week, you save $2. In the third week, you save $3, and then you gradually increase the amount that you save as the weeks go by. Since there are 52 weeks in the year, you're supposed to consistently put away cash until the very last week (where you save up to $52 in December). If you're successful, you should have saved a total of $1,378.

There are 52-Week Money Challenge apps to help you track your progress.

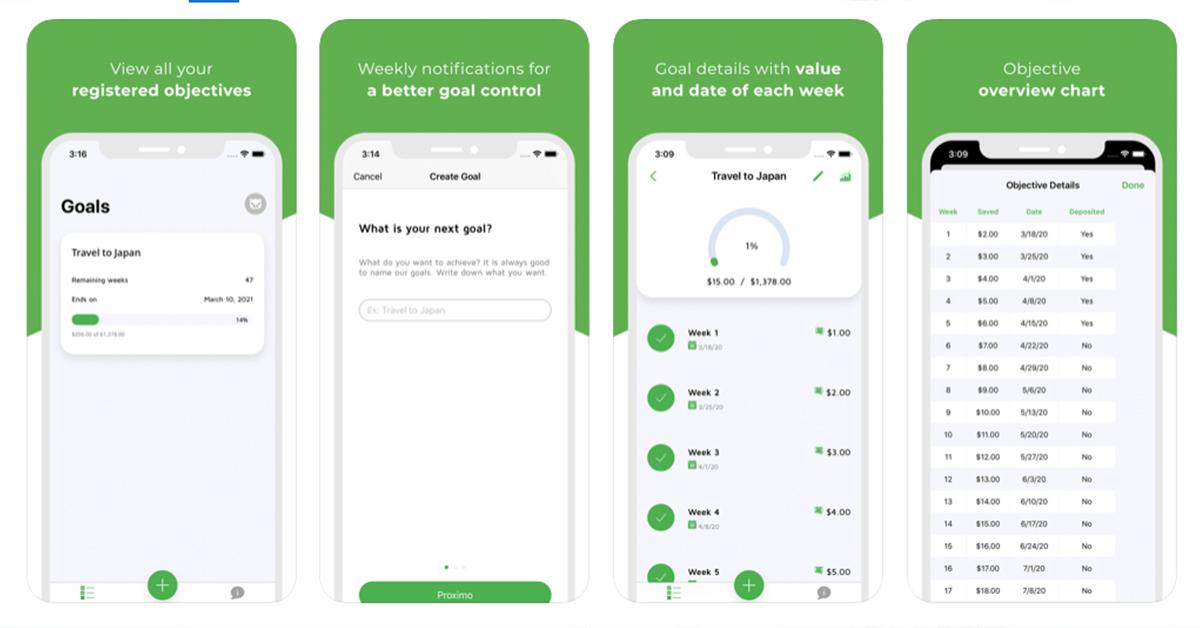

It’s fairly easy to keep track of this challenge because it only requires saving an extra dollar every week. However, if you struggle with being consistent and need an extra boost, you can choose from multiple apps that can help you stick to the challenge.

One of the more popular apps is "52 Weeks Money Challenge" by Mobills, which provides an overview chart and sends weekly notifications to help you achieve your goal. The app is available on both Google Play and the App Store.

Some people have tried the reverse method.

The basic 52-week challenge, which is considered the classic version, has worked for countless people, but many are turned off by the fact that it gets progressively more challenging. Especially since you have to save a whopping 50 bucks around Christmas time.

So, instead of following this exact method, many have done the opposite by starting off with $52 in the first week and ending with just a dollar by the end of December. With this method, you can get the hardest part out of the way and gradually decrease your amount, making it easier as the weeks go by. But if you typically struggle with saving, you may want to start off slow and stick with the original challenge.

You can make the 52-week challenge your own.

People have found creative ways to alter this challenge in a way that best suits them, although totals may vary (depending on personal goals). For example, there's the constant method, where you can save $26.50 each week. And then there's the odd/even savings method, where you can start by saving all the odd amounts first, then the even amounts.

You'd start with $1, $3, $5, and so forth until you reach $51. Then, you'd continue by saving the even amounts, starting with $2, $4, $6, and so on.

Another interesting method that people have tried is alternating. In this case, you'd alternate between the highest and the lowest savings amounts until you gradually get to the middle. So for instance, you'd save $1 in the first week, $52 in the second week, $2 in the third week, $51 in the fourth, and so on.

If you want to make it more exciting and fun, there's also the random draw method. You can either do it the old-fashioned way and draw a written number from a hat, or use an online generator that gives you a new number each week.

While these approaches are definitely creative, it might be difficult to keep track of your progress because they're a bit more complicated. However, all of them can be quite effective in helping you reach your savings goal.

There are 52-Week Money Challenge printable charts available.

You're probably wondering: "Is it too late to start saving?" In short, the answer is no. Though it's ideal to start at the beginning of the year, starting at any point is definitely better than not starting at all. To help you get started, you can either download one of the money challenge apps or get yourself a printable for 2021.

There are countless versions available on the web, but if you're just now starting, you can download this customizable chart, which allows you to set your start date, method, and total savings amount. Good luck!