“Rich People File for Bankruptcy” — Woman Urges People in Debt to Go Bankrupt, Internet Agrees

"Honestly it's the just a restart button."

Published July 2 2024, 6:31 p.m. ET

Donald Trump. Walt Disney. Stan Lee. George Foreman. Henry Ford. Milton S. Hershey. All of these people lived (and some died) to be extremely wealthy.

All of them, at some point or another, also filed for bankruptcy.

There's a stigma surrounding bankruptcy, and it's one that a TikToker named Kiki (@lifeaskiki_) says is unfair.

She implored her followers in a viral clip to consider declaring that they're bankrupt in order to get a fresh start and repair their credit. As one TikToker penned, they felt more comfortable making financial decisions when their "frontal lobe" was actually developed.

"I don't know if it's just my timeline but I've been seeing a lot of people posting when your car about to get repossessed, or when your credit score drops, or, when you in a whole bunch of debt and you can't afford to pay it and you hanging up on creditors. Let me just say this," she says, prefacing the potentially life-changing bit of advice she imparted on her viewers.

"Majority of y'all need to file bankruptcy. Majority of y'all need to file for bankruptcy. And before the credit defenders come on here saying how you wrong for not paying your bills and y'all this and that, please do not defend a company that wouldn't even come to your funeral. Like, really think about that," the TikToker says into the camera while tapping her head.

She says that she finds it bizarre there are people out there who appear wholly devoted to creditors and banks instead of other people who are struggling to make ends meet in an economy that's been in a precipitous downward spiral since 2021 (thanks current White House leadership).

"Don't fight so hard for them," she repeats before dispelling another misconception about bankruptcy: "And for those who say 'oh good luck buying a home,' you can buy a home in two years if you file chapter 7. Easily. And most of them saying that can't even buy a home anyway, all right?"

Kiki then decides to get into the truths about filing for the big, scary word that could potentially help folks if they're in mountains of debt: "So let's talk about it: bankruptcy. If your car is out for repossession you can stop it by filing bankruptcy. The rich do it all the time," she says, proving that just because you filed bankruptcy doesn't mean you're broke.

She goes on to dispel the negative connotations associated with bankruptcy, sharing a personal anecdote related to it: "The man who told me to file, he's an older man, but he owns the whole street of his neighborhood ... acres of land. And when he was younger he filed twice. To get a fresh start."

Kiki added, "It is so weird to me that that the rich utilize this resource way more than people who actually need it. Which is the poor. So, just ponder on that. This is not financial advice, just call an attorney and just talk to them," she said, urging folks who are in dire financial straits to seriously consider bankruptcy as an option that'll save them from any potential future financial heartbreak.

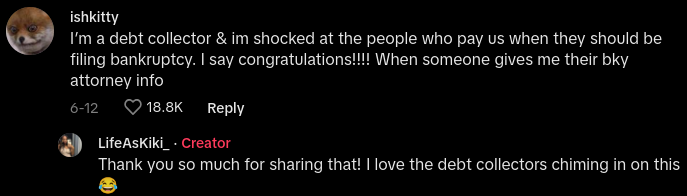

There were several other people who replied in the comments section of the video who shared their own two cents about filing for bankruptcy: "Honestly it's the just a restart button," one person wrote.

Another shared an apparently helpful resource for anyone else who is considering filing for bankruptcy: "Sign up for Met Life legal! They will pay for the bankruptcy attorney! You only pay filing fee."

Someone else remarked: "My mama always told me 'how you think these people got nice homes, they file bankruptcy.'"

"I didn’t realize so many people filed bankruptcy!!! The comments have me shook. This entire time I thought once I do that it’s over for me. Love this."

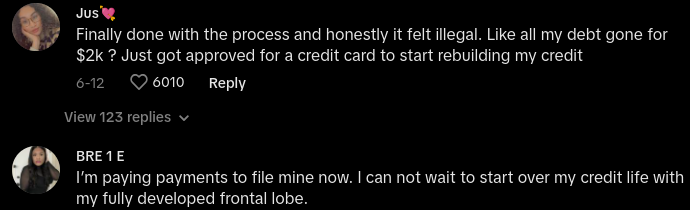

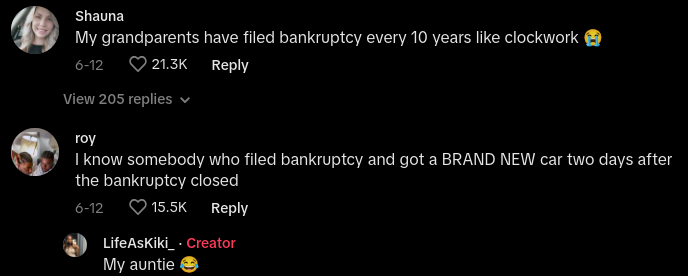

There was one TikToker who said that their grandparents even planned their bankruptcy claims and treated it like spring cleaning: "My grandparents have filed bankruptcy every 10 years like clockwork."

One person said that they personally filed for bankruptcy and ended up feeling like it was a cheat code for life: "Finally done with the process and honestly it felt illegal. Like all my debt gone for $2k? Just got approved for a credit card to start rebuilding my credit."

Someone else said that there are some things you should take care of first before you file, like making sure you've got a secure place to live in first: "PRO TIP: make sure you have a stable place to live before you file. Apartments and home will be hard for about two years."

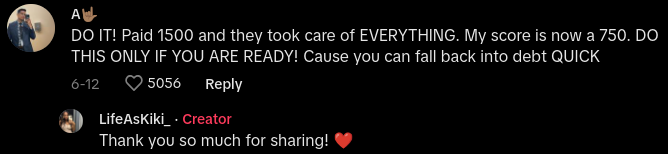

The more and more people who commented, the more it seemed like there were folks who ultimately were happy about their decision to file for bankruptcy: "DO IT! Paid $1,500 and they took care of EVERYTHING. My score is now a 750. DO THIS ONLY IF YOU ARE READY! 'Cause you can fall back into debt QUICK."

According to Investopedia, while there are different factors to consider when one files for bankruptcy, there are very very clear benefits for doing so: "Bankruptcy can often reduce or eliminate your debts, save your home, and keep bill collectors at bay. But it also has serious financial consequences, including long-term damage to your credit score. That, in turn, can affect your ability to borrow in the future."