Missed Student Loan Payments Now Affect Credit Scores

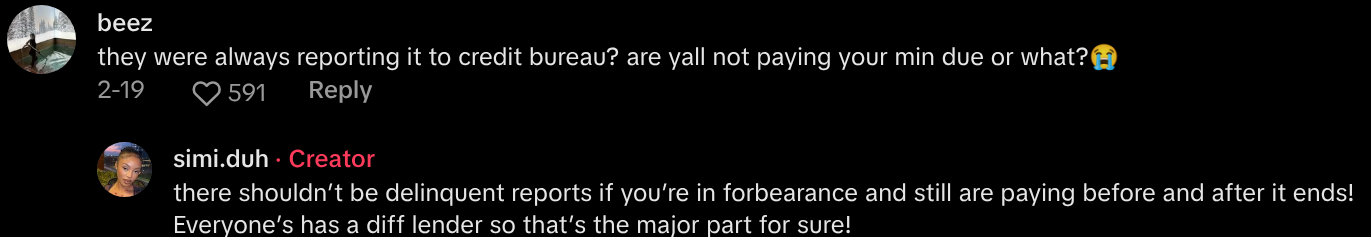

"They’ve always reported it to credit bureaus."

Published March 4 2025, 9:40 a.m. ET

A woman on TikTok is claiming that the Trump administration and Elon Musk are responsible for delinquent student loans now affecting folks' credit scores.

It appears that the drops are in line with the end of COVID-era protections against those with student loan debts, as numerous media outlets have reported.

The social media user, Simi (@simi.duh) expresses in a viral TikTok that she believes the drops are part of a larger ploy from the Trump administration. She says it's designed to keep individuals perpetually renting, instead of securing lower-interest rates on large loan sums for homes and vehicles.

Her video begins with a text overlay on the screen that reads, "protect your credit score from student loans."

"If you have student loans, please God watch this. So, under the Trump administration with Elon Musk, basically they're attacking student loans."

The TikToker continued, "What they're doing now is, although it was them who gave us that student loan break to not pay back our loans for a little bit. What they're doing now is putting it on your credit and putting it as like, a delinquent kind of case. Saying that you were late on paying your payment back."

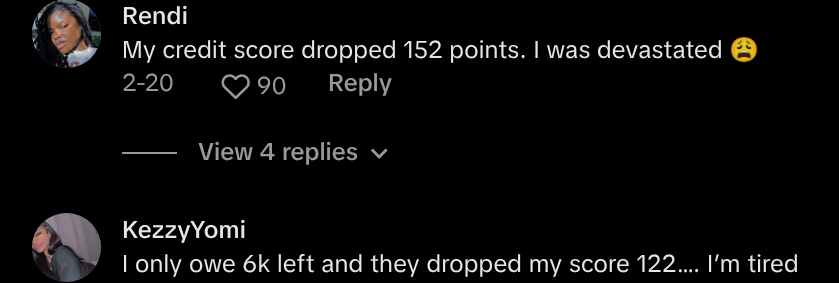

"So, they're putting it on your credit." Simi then went on to share an anecdote about someone she knows who had a significant drop in their credit score. The TikToker attributes this precipitation to the purported changes made to how delinquent student loan payments are factored into credit score assessments.

Simi states that anyone who has a child in college may have a cause for concern over their student loans. If a teen's parent decided to co-sign for a loan so they could get money to attend school, then their credit score could be affected too.

"Friend of mine's credit score jumped from 783 all the way down to a 608. And parents, you're not safe either. Because technically, if your child went to college, you are a cosigner on that loan."

According to Simi, her own mother's credit score dropped as a result of her delinquent student loan payments. "My mother's credit score went from a 790 to a 610. For all four of us ... She has four kids."

She attributed the current administration's decision to implement financial repercussions for not paying back student loans as part of a more overarching plan.

It's a scheme she says that's orchestrated to ensure individuals "don't own anything." Theoretically, this will make financing large-scale portions more difficult for anyone with unpaid student loans as they will either be denied acceptance of said loans or get slapped with high interest rates.

Consequently, individuals will be forced into renting. "So if you're trying to buy a house, a car, or get an apartment, whatever, please God just get on your Zoom and do it as quickly as you can and as efficient as you can, because they're literally trying to stop people from doing so much s--t right now."

Furthermore, she went on to criticize attempts at thriving financially in America as a difficult process. "Living in the states where everything goes through credit ... And the thing is even if you paid off all your debt and all that hits your credit is your student loans, that s--t is thousands of dollars."

Which means that even if you've never been late on a mortgage, rent, car, utilities, credit card, cell phone, etc. payment, the relatively high amount of student loan debt would negate all of that.

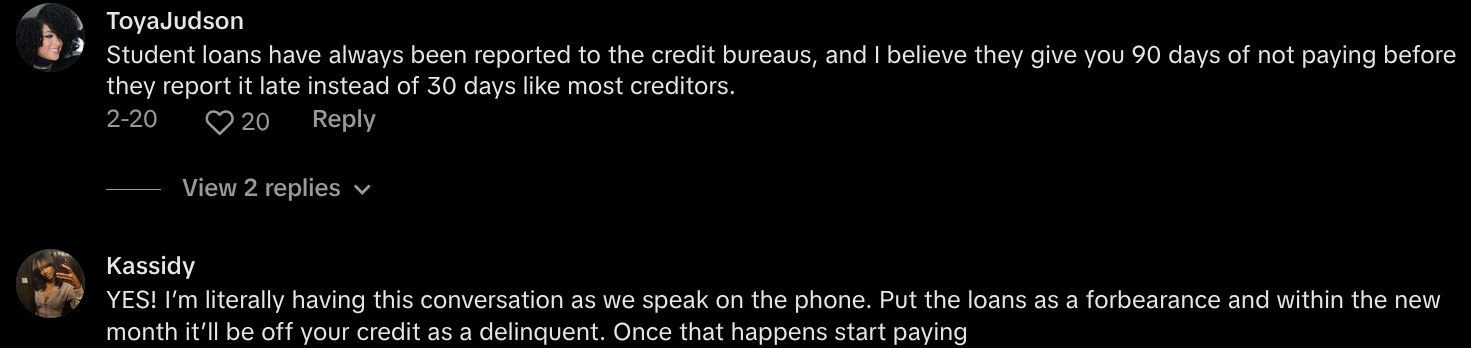

Numerous outlets have corroborated Simi's assertions regarding the negative affects unpaid student loan payments can have on their credit scores.

Forbes writes that some borrowers are experiencing credit score drops of up to 200 points as of 2025.

The outlet attributed the precipitation to "COVID-era protections" against people's credit scores coming to an end. "Millions of federal student loan borrowers enjoyed a rare reprieve during the pandemic. In March 2020, when the economic shock of COVID-19 hit, student loan payments were paused, and adverse credit reporting was suspended."

Forbes went on to state that during the Biden administration a "one-year 'on ramp' period, from September 2023 to September 2024" was implemented. This time of grace was designed to help folks ease back into their payment plans.

As of October 2024, any missed payments were then reported to credit bureaus. Subsequently, those who still didn't make payments had 90-days to catch up, and those who didn't started seeing the effects this had on their credit scores.