"Credit Scores Are Useless" — Woman Says No One Is Paying Back Student Loans Due to Cost of Living

Published Nov. 20 2023, 11:30 a.m. ET

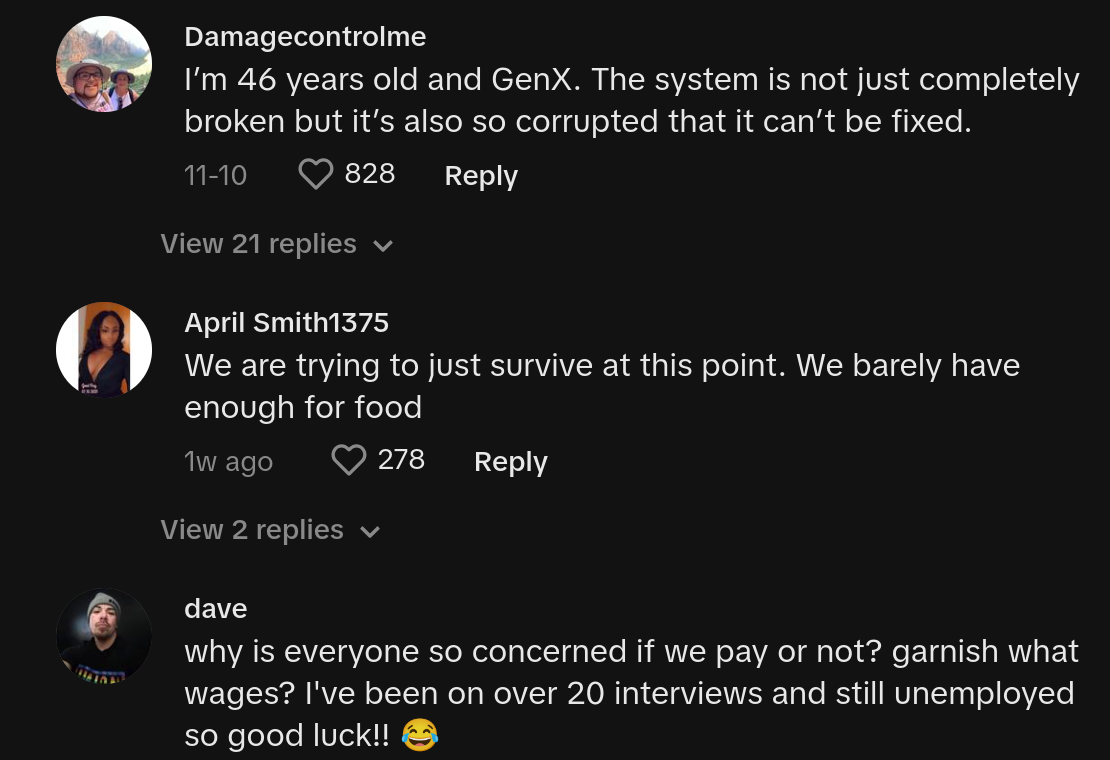

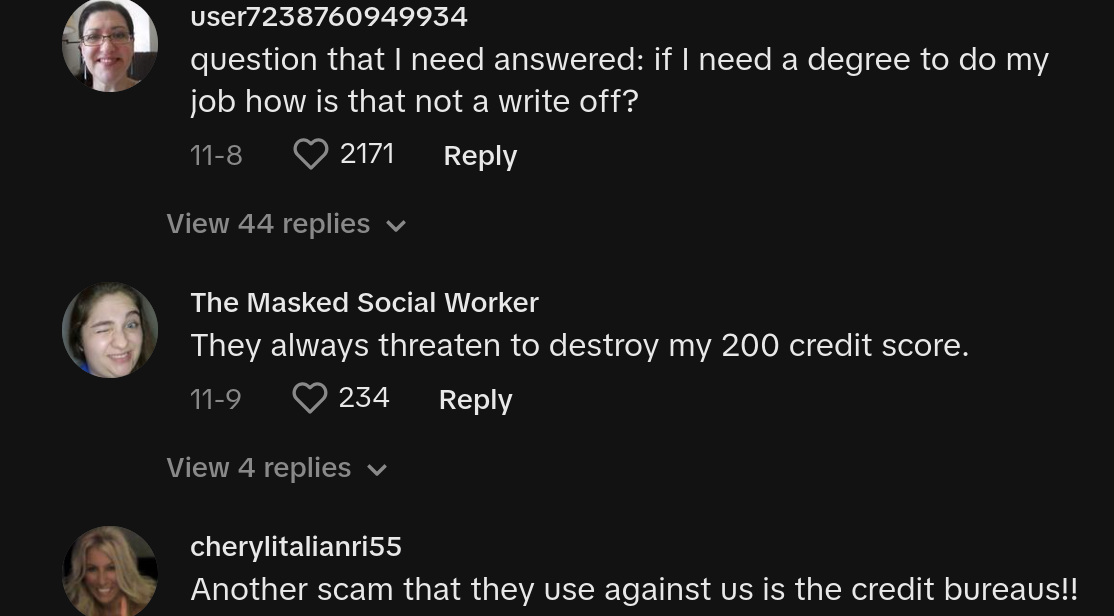

A TikToker's rant against the current state of the US economy, along with individual credit scores being taken hostage as part of a fear-based campaign warning citizens they may not be able to participate in society to the extent that they would like has gone viral.

TikTok user Sarah Rebecca Cook (@sarahrebeccacook) uploaded a viral response that she stitched to another user on the platform's own rant where they explain how US foreign aid policy has compelled them to never pay back their loans.

"I'm not paying for my student loans cause y'all got $100 billion to fund genocide," TikToker Naomi Luxe says in a now-deleted TikTok video that was stitched with Sarah's, who expounds upon Naomi's video.

"After this go watch the rest of that video and read the comments. because people are like so what if I don't pay my student loans what are you gonna do? Ruin my credit so I can't buy the house that I wasn't even gonna be able to buy ever in my lifetime anyways?"

Sarah went on to argue that folks aren't being incentivized to pay back their student loans for degrees that aren't even helping them to secure jobs that would allow them to pay said loans back.

To top it all off, the cost of living is so high, that the prospect of owning a home is becoming a pipe dream with an even slimmer and slimmer chance of coming to fruition for many Americans.

So in short: you've got a ruined economy that's been seeing massive spikes in inflation since 2021, a cost of living increase that is unprecedented in recent history, and legions of folks who've been sold the idea that getting a college degree, no matter what, would open up more career opportunities for them so that they could pay back the pricey loans they took to get them.

For many, that idea has ultimately been an empty promise, leaving a significant portion of America's population over-educated and under-employed. And it's these folks who feel like they've had the wool pulled over their eyes, who don't see an immediate value in paying off their student loans to help them get a house they had a better fiscal shot at of buying during the Great Depression, who are arguing that there's no reason for them to pay their loans back, ever.

"I just feel like all of the old fear tactics that were used against us are just simply not working because this system is so f----- broken so people just don't care anymore. When there's no way to win and the cards just keep getting stacked against you, at what point do you just go f--- it and start living life the way that you want to?"

The $100 billion that Naomi referred to in her video appears to be a reference to the US aid to Israel request after the country retaliated against the terrorist group Hamas for the October 7th attacks that resulted in approximately 1,200-1,400 deaths and 240 hostages. Many of the fatalities and kidnapped individuals reportedly consisted of children and elderly.

While Naomi's reasoning for not paying back her loans is steeped in her assessment of the fiscal moves the United States was proposing to make in order to help Israel subdue a terrorist threat that has claimed the lives of its citizens, there were others who seemed to base their reluctance to never pay a cent back in their student loans for other reasons.

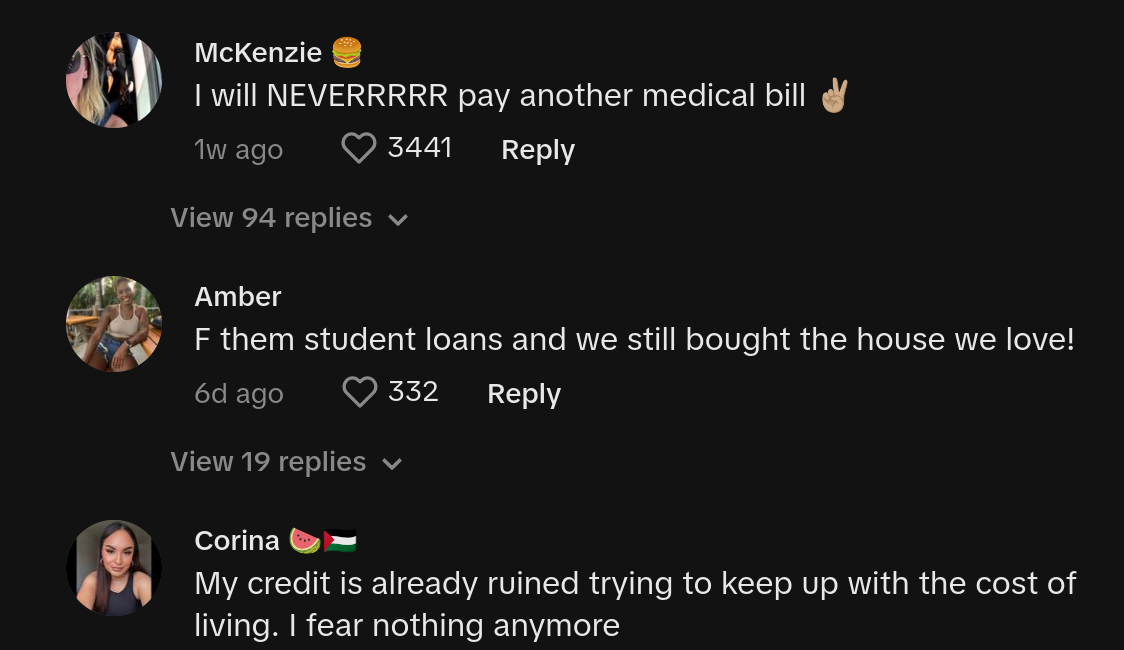

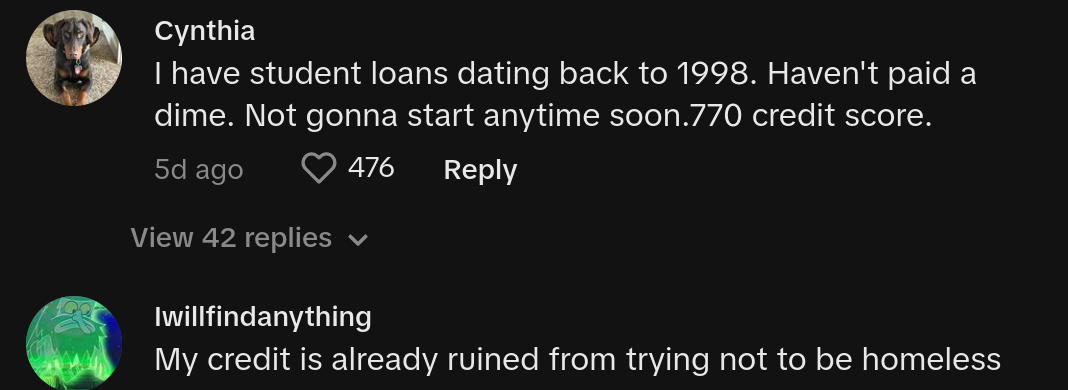

Like this one TikToker who said that they haven't paid anything towards the student loan balance they've carried for 25 years: "I have student loans dating back to 1998. Haven't paid a dime. Not gonna start anytime soon.770 credit score."

Another person wrote that since their credit has already tanked that they aren't too concerned with paying off their loans anyway: "My credit is already ruined trying to keep up with the cost of living. I fear nothing anymore"

One TikToker said that they were still able to put together enough money to buy a house despite having student loans that they apparently never paid off: "F them student loans and we still bought the house we love!"

Numerous financial outlets, however, had said that negative student loan balances could adversely affected folks' credit scores: US News Money, TransUnion, Citizens Bank, and plenty other of financial institutions and outlets have said that carrying high account balances that are in delinquency will more than likely bring down a person's credit score.

Weirdly enough, many folks who've completely cleared our their account balances have noticed a drop in their credit scores. Apparently, credit monitoring companies like to see individuals actively paying debts that are accruing some type of interest. So if you're fiscally responsible, or work hard enough are/successful and completely wipe out your debt, you could actually be punished for that by temporarily being slapped with a reduced credit score.