“Thought I'd Be Happy at 60K” — Woman Shocked After Calculating Her Ideal Salary

"So ridiculous how expensive just living is."

Published Aug. 11 2024, 11:37 a.m. ET

The whole point of having money is to be able to afford the type of lifestyle that you want to live. Of course, if you're living your life in order to impress other people and create some kind of appease-everyone-but-yourself image of success, no amount of money will ever be enough.

However, if you work backward and think about the things that really matter to you and want to do, you can get a much better picture of just how much cash you'll need to earn to live that actual dream life. And not the "dream life" that other people shill to you.

TikToker Rebecca Sowden (@rebecca.sowden) who says that she's a "recovering super spender" decided to answer that question for herself in a viral video.

"What income do you need to live your ideal life?" she writes in a text overlay of the clip.

She then cracks open a journal and a pen, stating that the first thing she wants to do is ensure that she's saving enough for retirement. Which includes "maxing out your 401k." That amount of cash is $23,000.

Next up is her placing a $7,000 maximum amount for her Roth IRA.

Rebecca then transitions to what seems like a touchy subject: a brand new $40,000 car that she intends to pay off in 40 years. This means she needs $10k to go towards this vehicle, which includes "tax and interest" along with all other fees.

Another thing that matters to her is travel. Rebecca wants to travel internationally at least once a year. She says she allocates $8,000 a year for that, but this fee also includes her husband's travel expenditures, too.

She then transitioned to writing down her living expenditures, such as rent and room/board. She says that his comes out to $5,000 a month for a mortgage for a house, including utilities "and all the other stuff and taxes."

"So $60,000 for being alive in a space in a place."

Rebecca then highlights other quality of life expenditures, such as internet, Spotify, phone bills, which comes out to around $300 per month.

However, she then adds that there are "exercise classes" that could jack that price up. Ultimately, she allocates $450 a month for subscriptions and "other ancillary bills." Yearly, that comes out to $5,400.

Seeing this figure makes her grimace and look away from her journal.

"Next we have food and transportation budget," she says. After doing some mental math, she says annually, that this comes out to around $12,000 a year just for "being alive."

Rebecca then says she wants to allocate an additional $20,000 for investments, despite not being "confident" about that amount.

The final bit of cash she says she wants to save as an "emergency fund" as a "catch all account" for various expenditures such as "Christmas" and anything else that pops up out of nowhere. The amount she wants to set aside for this is $10,000.

After adding everything up together, she grunts into her hand, which is placed firmly over her mouth. Her video then cuts to her looking down at her notebook as she relays the amount of money she'll need to be able to satisfy all of the figures she listed in the video.

It came out to $155,400 after taxes. Heading over to her computer, she then started Googling how much money post tax that comes out to in the state of California.

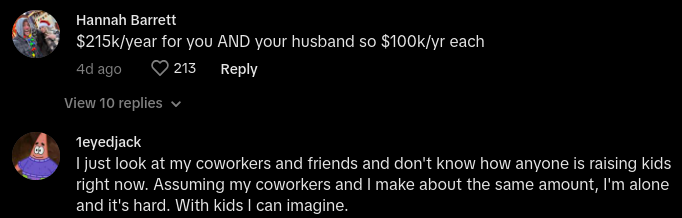

This means that she'll have to earn $215,000 annually in order to reach those goals.

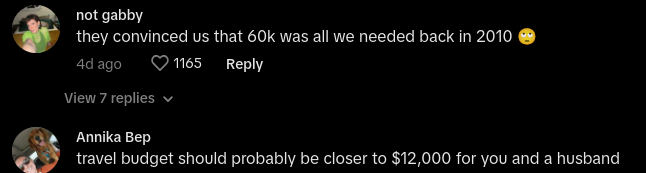

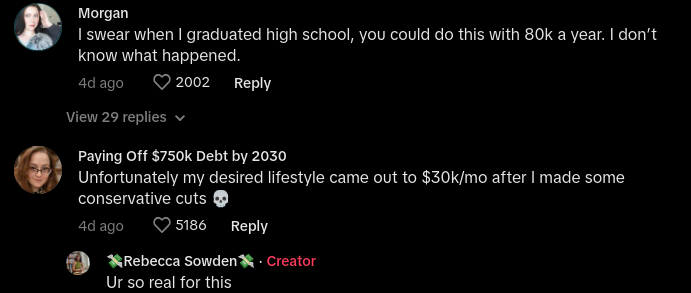

She said that while she was in high school, she thought having an annual salary of $60,000 would be enough for her to survive and pay for everything that she needed. However, upon crunching the numbers and living in the real world, she saw just how wrong she was.

Rebecca was even more surprised at the fact that she didn't factor in "luxury bags" or any other expenditures. After sitting down and looking at her list, she appeared concerned and said that she had to "sit with it" for a bit to process just how expensive it's become to live in the U.S. over the past few years.

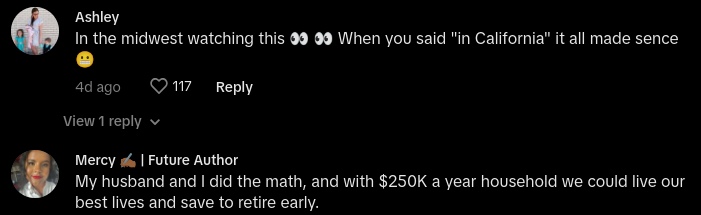

Numerous folks responded in the comments section that they, too, had the same mindset that Rebecca did when she was in high school. Others pointed out that her estimate didn't include children.

However, there were some people who remarked that cost of living expenditures will vary greatly depending on where you live, as well.