A 22-Year-Old Who Makes $25K a Month, Plus More Unrelatable Money Diaries

Updated Nov. 28 2018, 2:04 p.m. ET

Conventional wisdom will tell you to never compare yourself to other people: it just makes you feel inferior. Instead, you should focus on doing what makes you happy to the best of your ability. And if you want to follow this conventional wisdom, then I highly suggest you stay away from these money diaries.

I'm all about the whole "working for you" thing, but it's kind of hard to feel secure and good about yourself and what you're doing when there are people much younger and less educated than you making an absolute killing in their respective lines of work.

Like this 22-year-old entrepreneur who nets an average $25,000 a month. Yes, you read that right, they make that amount, on average, times 12, every single year. Refinery29 covered how this young woman spends her money in a single week and, for the amount of money she makes, she's actually pretty responsible.

But people understandably freaked out about just how much dough she's pulling in on average. She was able to launch a successful handbag business for herself, and the diary entries of her day actually seems pretty chill.

There's a lot of Netflix watching, hanging out with her boyfriend, and she doesn't follow a traditional 9-5 routine. She is, however, making the right moves, especially when it comes to saving her money. She squares away some $20,000 a month in high-interest yield savings accounts.

It gets better/worse, because it turns out that the post-publication edits to the piece show that the young entrepreneur actually earns even more money than was originally reported. She just reinvests a lot of it back into her business.

Of course, people had plenty of jokes and recommendations for how this young woman is spending her money. However, I'm probably going to side with the person who's just out of college and earns way, way, way more than I do. Clearly she's doing something right.

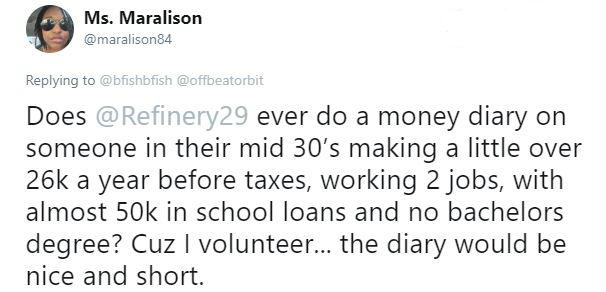

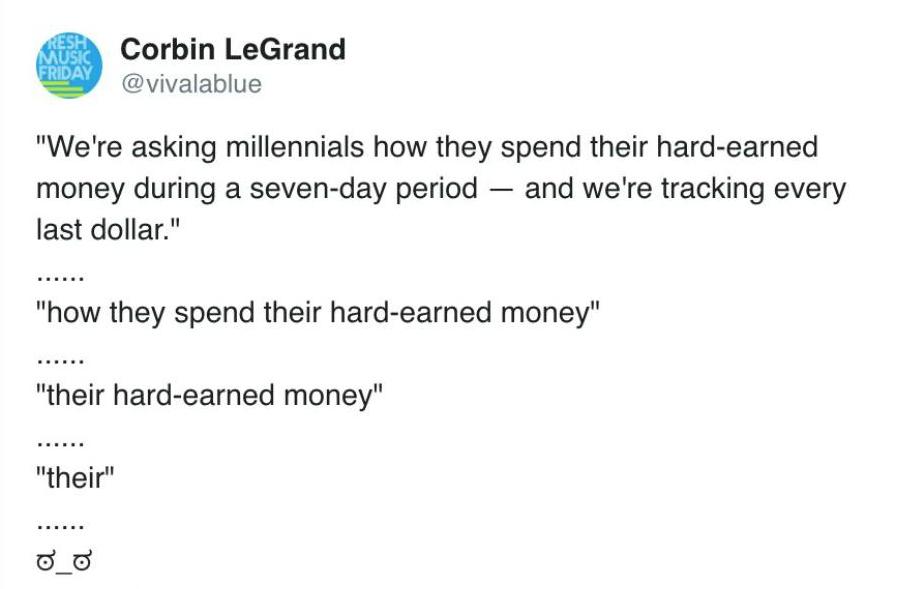

There were, of course some people who felt that online publications do money diaries on only obscenely wealthy people who don't really reflect what the average human being takes home from their job(s).

But Refinery29 was quick to point out that they do, in fact, write "money profiles" on everyday, normal folk who aren't earning tens of thousands of dollars while working on their successful self-owned businesses.

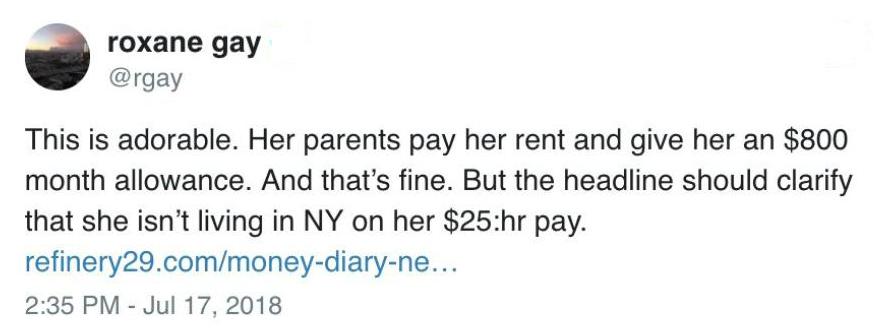

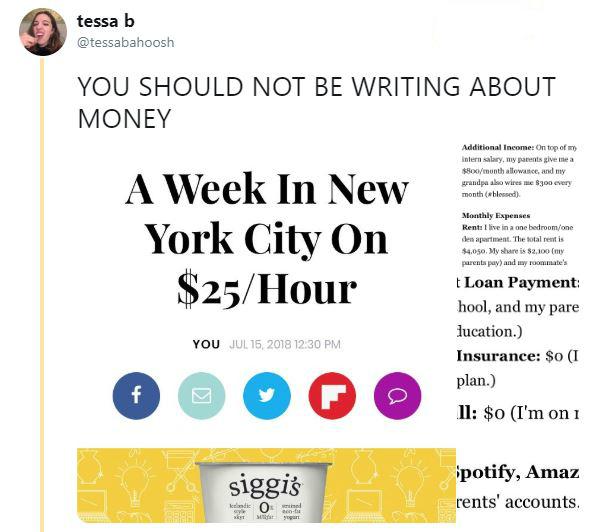

But I'd be remiss in failing to mention that some of these "regular folks" are not really earning what they say they're earning. Case in point, this intern who lives in NYC on only $25/hour.

What the original headline for the article fails to mention is that this young woman technically isn't living in NYC just on the $25 she earns. She's actually receiving a lot — and I mean a lot — of help from her parents.

The publication changed the headline to reflect that she has a monthly allowance from her parents of $1,100, not to mention that they also cover her rent, which comes in at a whopping $2,100 a month.

It was the object of so much ire online that popular writer Roxane Gay even chimed in.

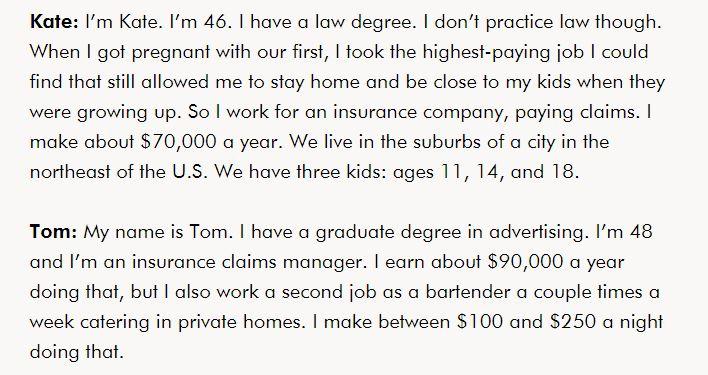

If you ever wanted to see a money profile that'll infuriate you to no end, look no further than this couple, who both work jobs with decent salaries (a combined income of about $160k a year, before taxes, not including the bartending gigs dad takes from time to time).

On the one hand, I can almost commiserate with these folks. I feel like I'm breaking my back working a full-time job and all the side gigs I'm constantly taking on. I never get more than 5-6 hours of sleep a night and am constantly creating and searching for other sources of revenue. And I know I'm not saving nearly as much as I could be saving due to a combination of vacations/trips/things I like doing.

But I know I'm not in as bad of shape as they are, because I haven't even dreamed of trying to own a home — I know I can't make the combination of mortgage payments in my area and the property taxes that come along with them.

They elected to move into a bigger house and often buy their kids expensive meals, like $15 Whole Foods sushi with smoothies. Not to mention the super pricey private school tuition they clearly can't afford.

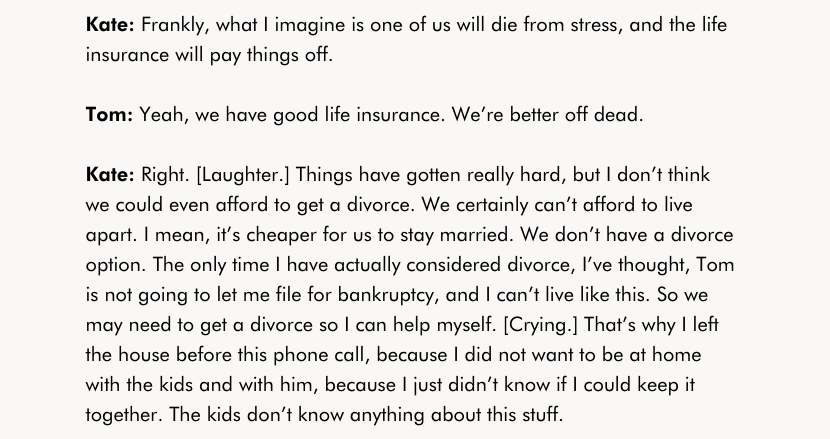

Probably the saddest part of the story is when Tom and Kate, the couple in question, talk about how they can't even afford to get divorced. Kate says that one of the reasons they stay together is that it just makes sense financially to keep trucking along in holy matrimony.

What's most maddening is that, despite their above-average combined incomes, they just can't manage to get out of debt and they don't even truly know how much they've incurred. Instead, they choose to bury their heads in the sand while signing up for the many unsolicited credit card offers that come in the mail.

Honestly, that seems like what a lot of people are doing now. With massive amounts of student loans, people can't seem to afford things like clothes and incidentals, so they charge them. Oh well, there's always the Powerball or that one great idea you're just waiting to show the billionaires on Shark Tank.